Imperial Oil

Imperial Oil, a Canadian refiner, has announced its forecast for higher upstream production in 2024. The company anticipates a production range between 420,000 and 442,000 gross oil equivalent barrels per day. This projection signifies an increase compared to its guidance for the year 2023.

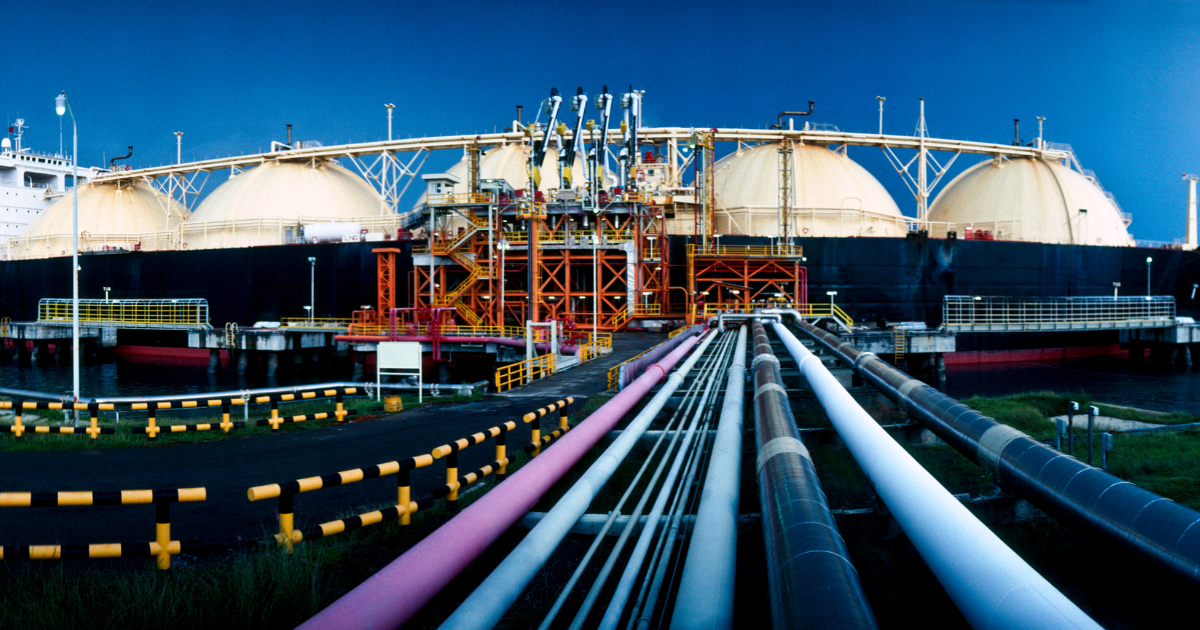

The boost in upstream production suggests that Imperial Oil is expecting increased output from its exploration and production activities, which involve extracting crude oil and natural gas from wells. This positive outlook for production aligns with broader industry expectations, as indicated by the Canadian Association of Energy Contractors, which anticipates an 8% increase in well drilling activities in 2024.

The company’s optimism about higher production may be influenced by several factors. Greater access to pipelines, as mentioned in the forecast, could contribute to improved efficiency in transporting extracted resources to markets. Additionally, expectations of increased oil demand, as forecasted by BofA Global Research, may further support Imperial Oil’s positive outlook for production in 2024. The potential end of the U.S. Federal Reserve’s monetary tightening cycle, as mentioned in the context of emerging markets benefiting from it, could also play a role in driving oil demand.

Imperial Oil’s downstream operations, involving refining and processing crude oil into various petroleum products, are also part of the company’s considerations. The company expects throughput from downstream operations to be between 385,000 and 400,000 barrels per day in the coming year.

To support its production and operational plans, Imperial Oil has outlined a capital expenditure forecast of C$1.7 billion for 2024. This capital investment is consistent with the company’s previous forecast for 2023, indicating a commitment to ongoing development and growth initiatives.

IMO Stock Analysis

According to the Imperial Oil Ltd stock forecast provided by 13 analysts, the consensus is that the average target price for the company’s stock over the next 12 months is CAD 81.23. This target price represents the analysts’ assessment of the stock’s potential value in the coming year based on various factors such as financial performance, industry trends, and market conditions.

The average analyst rating for Imperial Oil Ltd is classified as “Buy,” suggesting an overall positive sentiment among analysts regarding the company’s prospects. This rating indicates a collective belief that investors should consider purchasing the stock based on its expected performance and potential for growth.

Stock Target Advisor, an independent stock analysis service, has conducted its own assessment of Imperial Oil Ltd’s stock. According to their analysis, the outlook is categorized as “Slightly Bullish.” This classification is derived from evaluating 10 positive signals and 5 negative signals related to the company’s stock. These signals could include various technical and fundamental indicators, market sentiment, and other factors that analysts consider when assessing a stock’s potential direction.

As of the last closing, Imperial Oil Ltd’s actual stock price was CAD 75.78. Over the past week, the stock price has experienced a positive change of +2.77%, while over the past month, it decreased by -4.21%. However, looking at the stock’s performance over the last year, there has been a notable increase of +18.67%, suggesting a positive trend over a more extended period.