Stock Target Advisor Stock Research Tools

Stock Target Advisor is a website that provides investment direction and analysis to both professional and individual investors. It offers a range of features and tools to help investors make informed decisions about their investments.

The website provides information on various stocks, including historical prices, financial data, and analyst recommendations. This allows investors to stay up to date with the latest market trends and make informed decisions about which stocks to invest in.

One of the key features of Stock Target Advisor is its target price system. The site uses a proprietary algorithm to calculate target prices for stocks based on various factors, such as earnings estimates, industry trends, and market conditions. The target price system is designed to help investors make informed decisions about buying and selling stocks.

The target price system takes into account a wide range of factors when calculating a target price for a stock. This includes the company’s financial performance, growth prospects, and industry trends. It also considers macroeconomic factors such as interest rates and inflation.

In addition to its target price system, Stock Target Advisor offers a range of other features and tools to help investors manage their portfolios. This includes portfolio tracking, watchlists, and personalized alerts. The site also provides news and analysis on various market sectors, allowing investors to stay informed about trends and developments in different industries.

Overall, Stock Target Advisor is a useful tool for investors who want to stay up to date with the latest market trends and make informed investment decisions. Its target price system and range of other features can help investors to identify opportunities and manage their portfolios more effectively.

Why does the stock market seem so complex and why does it intimidates most people?

The stock market can be a complex and intimidating place for many people due to its sheer size, scope, and volatility. The stock market is a vast and interconnected network of investors, companies, traders, and financial institutions, all working together to buy and sell shares of publicly traded companies.

At the heart of the stock market is the concept of supply and demand. The price of a stock is determined by the forces of supply and demand, which are influenced by a variety of factors such as company performance, industry trends, economic indicators, geopolitical events, and investor sentiment. These factors can be difficult to understand and can change rapidly, making it challenging for many people to keep up with the market’s ups and downs.

Moreover, the stock market is governed by complex rules and regulations, which can further add to the confusion and intimidation for many people. Understanding these rules and regulations is essential for making informed investment decisions, but it can take time and effort to do so.

Additionally, the stock market can be unpredictable and volatile, with sudden and significant fluctuations in stock prices occurring frequently. This can make it difficult for even seasoned investors to predict market trends accurately, let alone those who are new to investing.

Finally, the abundance of financial jargon and technical terms used in the stock market can also intimidate people, making them feel like they need specialized knowledge or education to participate. Terms such as “dividends,” “earnings per share,” “market capitalization,” and “price-to-earnings ratio” may be unfamiliar and daunting for many people, making it challenging for them to make informed investment decisions.

Overall, the complexity and unpredictability of the stock market, combined with the abundance of rules, regulations, and technical jargon, can be overwhelming for many people, leading them to feel intimidated and unsure about investing in the stock market. However, with time, effort, and education, it is possible for anyone to gain a basic understanding of the stock market and make informed investment decisions.

Common Misconceptions About the Stock Market

There are several common misconceptions about the stock market that can lead to confusion and misunderstanding. Here are a few examples:

- The stock market is a form of gambling: Some people believe that investing in the stock market is just like gambling. However, while both involve risk, investing in the stock market is different from gambling. Investing involves analyzing a company’s financial statements, industry trends, and other relevant factors to make informed decisions about buying or selling stocks.

- You need to be wealthy to invest in the stock market: Many people believe that you need a lot of money to invest in the stock market. However, this is not necessarily true. While having more money to invest can certainly help, there are many ways to invest in the stock market with smaller amounts of money, such as through fractional shares or mutual funds.

- The stock market always goes up: Some people believe that the stock market always goes up over time. While it is true that over long periods of time, the stock market has historically provided positive returns, there have also been periods of significant volatility and even extended bear markets. It is important to understand that investing in the stock market involves risk and there is always the possibility of losing money.

- You need to follow the news constantly to be a successful investor: Some people believe that to be a successful investor, you need to constantly monitor financial news and market trends. While staying informed can certainly be helpful, it is not necessary to be a successful investor. In fact, many successful investors adopt a long-term approach and focus on investing in companies they believe in, rather than trying to time the market based on short-term news or trends.

- The stock market is only for experienced investors: Some people believe that the stock market is only for experienced investors. However, this is not necessarily true. While experience can certainly be helpful, there are many resources available to help novice investors learn about the stock market and make informed investment decisions. It is important to do your own research and consult with a financial advisor before making any investment decisions.

Stock market is an exclusive club for the wealthy?

No, the stock market is not an exclusive club for the wealthy. Anyone can participate in the stock market and invest in stocks, regardless of their income or wealth. In fact, investing in the stock market is a popular way for people to build wealth over time and achieve their financial goals.

While it is true that some wealthy individuals and institutions may have more resources to invest in the stock market, there are many ways for individual investors to get started with smaller amounts of money. Many online brokers offer low minimum investment requirements, and there are a wide variety of investment options available, including mutual funds and exchange-traded funds (ETFs), which allow investors to buy shares in a diversified portfolio of stocks with a relatively small investment.

It is also important to note that investing in the stock market carries risk, and it is important for individuals to do their research and understand the potential risks and rewards before investing. However, with the right knowledge and strategy, anyone can participate in the stock market and potentially grow their wealth over time.

Misconceptions about the volatility of the stock market

One of the main common misconception about the stock market is that it is inherently volatile and risky, leading many people to believe that investing in stocks is akin to gambling. While it is true that the stock market can experience significant fluctuations in value over short periods of time, this does not necessarily mean that investing in stocks is a risky proposition.

In fact, over the long term, the stock market has historically provided investors with relatively stable returns. For example, according to data from the S&P 500 index, which tracks the performance of 500 large-cap stocks listed on the NYSE and NASDAQ, the average annual return from 1926 to 2020 was around 10%. While there were certainly periods of volatility and market downturns during this time period, the overall trend was one of steady growth.

One reason for this misconception about volatility is the media’s tendency to focus on market downturns and sensationalize them in headlines. While downturns can certainly be painful for investors who are heavily exposed to the market, they are a natural part of the stock market’s cycle and should not be viewed as an inherent flaw of the system.

Another reason for this misconception is that many people only pay attention to the most high-profile stocks or the overall market indices, which can be subject to greater volatility than other stocks. In reality, there are thousands of publicly traded companies in a wide range of industries, each with its own unique risk profile and growth potential.

Finally, it is important to note that the level of volatility in the stock market is largely dependent on an individual’s investment strategy and risk tolerance. For example, investing in individual stocks may be riskier than investing in diversified mutual funds or exchange-traded funds (ETFs) that track the performance of a broad range of stocks. Therefore, it is crucial for investors to understand their own risk tolerance and investment goals when considering investing in the stock market.

Successful investing requires advanced financial knowledge?

It is a common misconception that successful investing requires advanced financial knowledge. While having some understanding of finance and investing can certainly be helpful, it is not necessary to be an expert to make smart investment decisions.

Many investment options, such as index funds, mutual funds, and target-date funds, are designed to be accessible to people without a lot of financial knowledge. These investment options are managed by professionals who have the expertise to make informed investment decisions on behalf of investors.

In addition, many financial institutions and brokerage firms offer educational resources and tools to help individuals learn about investing. These resources can range from basic information on investing to more advanced topics, such as portfolio diversification and risk management.

It’s also important to note that successful investing is not just about having financial knowledge, but also about having a solid investment strategy and sticking to it. This means setting clear investment goals, diversifying your portfolio, regularly reviewing your investments, and making adjustments as necessary.

In summary, while some financial knowledge can be helpful when it comes to investing, it is not a requirement for success. Many investment options are designed to be accessible to people without a lot of financial expertise, and there are plenty of educational resources available to help individuals learn about investing. Ultimately, a sound investment strategy and disciplined approach are key to successful investing.

How the Stock Market Really Works!

The stock market is a complex system that facilitates the buying and selling of securities, which can include stocks, bonds, and other financial instruments. It is a crucial component of modern finance and is used by companies and investors to raise capital and make investments.

At its core, the stock market is a network of buyers and sellers who exchange shares of companies. When a company first decides to go public, it issues an initial public offering (IPO), which allows it to raise capital by selling shares of ownership in the company to the public. These shares are then traded on stock exchanges, which are platforms that allow buyers and sellers to exchange shares.

The price of a share is determined by supply and demand: when there are more buyers than sellers, the price of the share goes up, and when there are more sellers than buyers, the price goes down. The market price of a share is influenced by a variety of factors, including company earnings, news and announcements, market trends, and broader economic conditions.

Investors buy and sell shares of companies for a variety of reasons, including to earn income through dividends, to speculate on the future price of the shares, or to gain ownership in a company they believe in. Investors can also use various strategies to manage risk and maximize returns, such as diversifying their portfolios or using technical analysis to identify buying and selling opportunities.

The stock market can be a powerful tool for individuals and companies looking to build wealth and grow their businesses. However, it is important to remember that investing in the stock market carries risk, and success requires a solid understanding of the underlying principles and careful consideration of one’s investment strategy.

Factors that influence the stock market

Several factors can influence the stock market, including:

- Economic Indicators: Economic indicators such as gross domestic product (GDP), inflation, interest rates, and employment data can have a significant impact on the stock market. For example, if the GDP growth rate is high, it indicates a healthy economy, which can lead to an increase in stock prices.

- Corporate Earnings: The earnings and revenue growth of individual companies can significantly affect their stock prices. Companies that consistently report strong earnings growth are generally viewed positively by investors, which can lead to an increase in the stock price.

- News and Current Events: News and current events, such as natural disasters, geopolitical tensions, and government policies, can influence investor sentiment and impact the stock market. For example, the outbreak of the COVID-19 pandemic in early 2020 led to a significant decline in global stock markets.

- Interest Rates: Interest rates can impact the stock market because they affect the cost of borrowing and the return on investment. Higher interest rates can lead to lower stock prices as it makes borrowing more expensive for businesses and decreases their profitability.

- Company Announcements: Company announcements, such as mergers and acquisitions, new product launches, or management changes, can significantly impact stock prices. Positive announcements can lead to an increase in stock prices, while negative announcements can cause a decline.

- Investor Sentiment: Investor sentiment can have a significant impact on the stock market. If investors are optimistic about the future, they are more likely to invest, which can lead to an increase in stock prices. Conversely, if investors are pessimistic, they are more likely to sell their stocks, which can lead to a decline in prices.

What are stock market cycles?

The stock market cycles refer to the repetitive pattern of market movements that occur over time. These cycles are typically divided into four phases: accumulation, markup, distribution, and markdown.

- Accumulation: This phase is characterized by low trading volumes and prices, as investors slowly start to accumulate stocks. Smart money, such as institutional investors and fund managers, typically invest during this phase.

- Markup: This phase is marked by increasing prices and trading volumes, as more investors start to buy stocks. The momentum continues to build, and prices often rise rapidly during this phase.

- Distribution: This phase occurs when investors start to sell stocks to realize their gains. The volume of trades is high, but the prices remain relatively stable. During this phase, the smart money starts to unload their positions.

- Markdown: This is the final phase of the cycle and is characterized by declining prices and low trading volumes as investors continue to sell their positions. Panic selling can occur during this phase, and the market may experience sharp declines.

These cycles are influenced by a variety of factors, including:

- Economic indicators: Economic indicators such as GDP, inflation, and unemployment can have a significant impact on the stock market cycles. Positive economic indicators can drive the market up, while negative indicators can cause it to decline.

- Interest rates: Changes in interest rates can also affect the stock market cycles. When interest rates are low, investors are more likely to invest in stocks, driving prices up. Conversely, when interest rates are high, investors may be more likely to invest in other assets, such as bonds.

- Corporate earnings: The earnings reports of individual companies can also impact the stock market cycles. Positive earnings reports can boost investor confidence and drive prices up, while negative earnings reports can have the opposite effect.

- Political events: Political events, such as elections, trade agreements, and geopolitical tensions, can also influence the stock market cycles. These events can create uncertainty in the market, causing investors to buy or sell stocks based on their perceptions of the impact of these events on the economy and markets.

Understanding stock market reports and analysis

Understanding stock market reports and analysis is important for investors who want to make informed decisions. Here are some key elements to look for in stock market reports and analysis:

- Market Index: A market index is a benchmark that tracks the performance of a group of stocks. The most commonly used market indexes in the US are the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. These indexes provide an overview of how the overall market is performing.

- Company Profile: Stock market reports often include a company profile that provides information about the company’s business, products or services, management team, financial performance, and other relevant details. This information can help investors understand the company’s strengths, weaknesses, opportunities, and threats.

- Earnings Reports: Earnings reports are one of the most important pieces of information that investors use to evaluate a company’s financial health. These reports provide details about the company’s revenue, earnings, expenses, and profit margins. Investors look at earnings reports to determine if a company is profitable and if its stock is likely to increase in value.

- Analyst Recommendations: Analysts who cover stocks often provide recommendations on whether to buy, hold, or sell a particular stock. These recommendations are based on their analysis of the company’s financial performance, industry trends, and other factors that may impact the stock’s price.

- Technical Analysis: Technical analysis is a method of evaluating stocks by looking at past market data, such as price and volume. Technical analysts use charts and other tools to identify patterns and trends that may indicate future price movements.

- Market Commentary: Market commentary provides analysis and insight into current market trends and events. This can help investors understand how broader economic factors, such as interest rates, inflation, and geopolitical risks, may impact the stock market.

- Risk Assessment: Stock market reports and analysis should include a discussion of the risks associated with investing in a particular stock or the overall market. Investors should be aware of the potential risks of investing in stocks, including market volatility, economic downturns, and company-specific risks.

In summary, understanding stock market reports and analysis requires a basic knowledge of key financial metrics and an awareness of the broader economic and market factors that may impact stock prices. By keeping a close eye on market trends, company performance, and analyst recommendations, investors can make informed decisions about buying and selling stocks.

How the Stock Target Advisor Analysis Tool and how it can help you

Stocktargetadvisor.com can help investors be successful by providing them with various tools and features that can aid in their investment decisions. Here are some ways in which the site can help:

- Target price system: One of the key features of stocktargetadvisor.com is its proprietary algorithm that calculates target prices for stocks based on various factors, including earnings estimates, industry trends, and market conditions. This can help investors make informed decisions about buying and selling stocks.

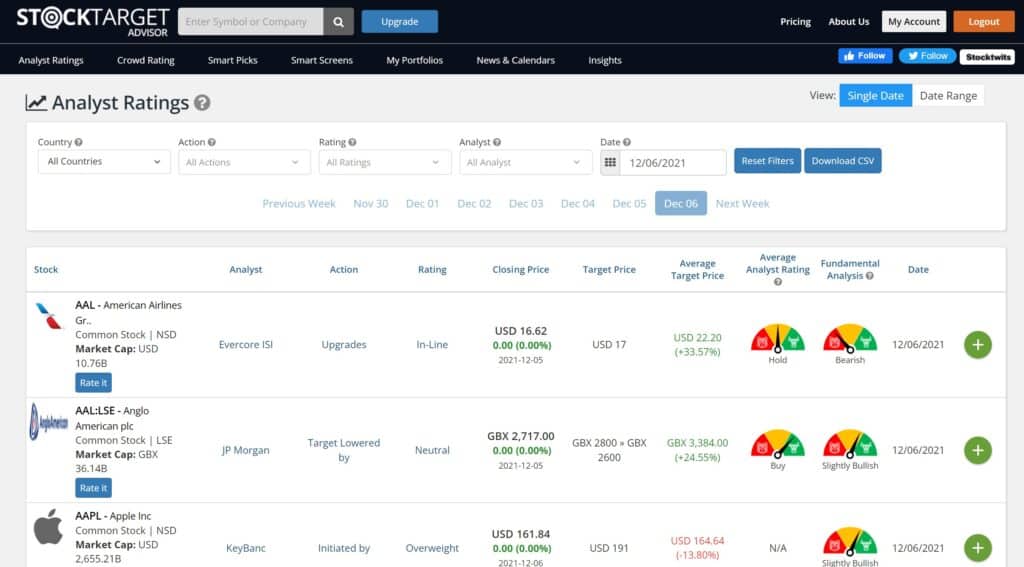

- Analyst recommendations: The site provides information on various stocks, including financial data and analyst recommendations. Investors can use this information to gain insights into the performance of different stocks and to inform their investment decisions.

- Portfolio tracking: Stocktargetadvisor.com offers a portfolio tracking tool that allows investors to monitor the performance of their investments in real-time. This can help investors stay on top of their holdings and make adjustments as needed.

- Watchlists and personalized alerts: The site also offers watchlists and personalized alerts that can notify investors of changes in stock prices, analyst recommendations, and other market trends. This can help investors stay informed about their investments and take action when necessary.

- Education and resources: Stocktargetadvisor.com also provides educational resources and articles on investing, as well as market news and analysis. This can help investors stay up-to-date on market trends and make informed decisions about their investments.

What are the Benefits of using Stock Target Advisor Analysis Tool

There are several benefits of using Stock Target Advisor analysis tool, including:

- Target prices: Stock Target Advisor uses a proprietary algorithm to calculate target prices for stocks based on various factors, including earnings estimates, industry trends, and market conditions. This can provide investors with a more informed basis for making investment decisions.

- Historical data: The platform provides users with access to historical data for stocks, including pricing and financial data. This can help investors to identify trends and patterns in stock performance, which can inform their investment strategies.

- Analyst recommendations: The site provides access to analyst recommendations, which can be a valuable resource for investors looking to make informed investment decisions. These recommendations are based on expert analysis and can provide insights into market trends and potential investment opportunities.

- Portfolio tracking: Stock Target Advisor offers portfolio tracking tools that allow investors to monitor the performance of their investments in real-time. This can help investors to make more informed decisions about when to buy, hold or sell stocks.

- Personalized alerts: Users can set up personalized alerts for stocks they are interested in, which can notify them of significant price movements or changes in analyst recommendations. This can help investors to stay on top of the latest developments in the market and adjust their investment strategies accordingly.

Overall, the Stock Target Advisor analysis tool can be a valuable resource for investors looking to make informed decisions about their investments in the stock market. It provides access to a wealth of data, analysis, and expert recommendations, which can help investors to identify potential investment opportunities and make more informed decisions about their portfolio.

Increased chances of making informed decisions by using Stock Target Advisor

Using Stock Target Advisor can increase an investor’s chances of making informed decisions by providing them with access to a wide range of tools and features that can help them analyze stocks and make well-informed investment decisions. Some of the benefits of using Stock Target Advisor include:

- Comprehensive Information: Stock Target Advisor provides a wealth of information on various stocks, including historical prices, financial data, and analyst recommendations. This information can help investors gain a better understanding of the performance and potential of the stocks they are interested in.

- Target Price System: Stock Target Advisor’s target price system uses a proprietary algorithm to calculate target prices for stocks based on various factors, including earnings estimates, industry trends, and market conditions. This system can help investors make informed decisions about buying and selling stocks.

- Portfolio Tracking: Stock Target Advisor allows investors to track their portfolios and monitor the performance of their investments. This can help investors make timely adjustments to their portfolios as needed.

- Watchlists: Stock Target Advisor enables investors to create watchlists of stocks they are interested in. This can help investors stay on top of market trends and news related to the stocks on their watchlists.

- Personalized Alerts: Stock Target Advisor provides personalized alerts to investors based on their preferences and investment goals. These alerts can help investors stay informed about important market developments and make timely investment decisions.

By providing investors with access to these tools and features, Stock Target Advisor can help investors make informed decisions and improve their chances of success in the stock market.

How to Identify the best stocks to invest in using Stock Target Advisor

Using Stock Target Advisor, investors can identify potentially profitable stocks to invest in by following these steps:

- Research and analyze stocks: Use the various tools and features on Stock Target Advisor to research and analyze different stocks. Review the stock’s historical prices, financial data, and analyst recommendations.

- Determine the stock’s target price: Stock Target Advisor’s proprietary algorithm calculates a target price for each stock based on various factors, including earnings estimates, industry trends, and market conditions. Investors can use this target price as a benchmark for determining whether a stock is undervalued or overvalued.

- Review the stock’s ratings: Stock Target Advisor provides ratings for each stock based on its target price and other factors. The ratings can help investors determine the potential profitability and risk associated with a particular stock.

- Monitor the stock’s performance: After investing in a stock, investors can use Stock Target Advisor to monitor the stock’s performance and receive personalized alerts when the stock reaches a certain price level.

By using these steps, investors can make informed decisions and increase their chances of investing in profitable stocks. However, it is important to note that investing in the stock market involves risks, and investors should always conduct their own research and consult with a financial advisor before making any investment decisions.

How to avoid common investing mistakes

Investing can be a challenging and risky task. Here are some tips to avoid common investing mistakes:

- Do your research: Before investing in a stock or a company, make sure you understand the business model, financial statements, and industry trends. Don’t rely on tips or rumors.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your investments by investing in different industries, sectors, and asset classes.

- Have a long-term investment horizon: The stock market can be volatile in the short-term, but it tends to perform well in the long-term. Avoid making knee-jerk reactions to short-term market fluctuations and have a long-term investment horizon.

- Don’t try to time the market: Trying to predict when the market will go up or down is a risky strategy. Instead, focus on investing in quality companies at a fair price.

- Avoid emotional investing: Emotions such as fear and greed can lead to irrational investing decisions. Stick to your investment strategy and avoid making impulsive decisions based on emotions.

- Keep an eye on fees: Fees can eat into your investment returns over time. Make sure you understand the fees associated with your investments and choose low-cost options where possible.

- Seek professional advice: If you’re unsure about how to invest or need guidance on building a portfolio, consider seeking advice from a financial advisor. They can help you avoid common investing mistakes and develop a strategy that’s right for you

Maximizing your investment gains using Stock Target Advisor!

In summary, the Stock Target Advisor Analysis Tool offers a comprehensive range of features and tools that can help small investors make informed investment decisions. However, it is important to remember that all investments come with a degree of risk, and consulting with a financial advisor before making any investment decisions is always recommended.

One of the key benefits of using the Stock Target Advisor Analysis Tool is its stock screener feature, which allows investors to filter through thousands of stocks and identify the ones that meet their specific criteria. The tool also offers investment ideas and detailed stock reports, which provide in-depth analysis and insights into individual stocks, helping investors to make more informed investment decisions.

By using the Stock Target Advisor Analysis Tool, investors can avoid common investing mistakes, such as making emotional decisions or investing in stocks without conducting adequate research. This can increase their chances of success and ultimately lead to higher investment returns.

Overall, the Stock Target Advisor Analysis Tool is a powerful research platform that can help investors of all levels achieve their investment goals. By signing up and using the tool, investors can unlock the full potential of their investment portfolio and make more informed investment decisions.