Saudi Arabia cuts Oil Production

According to Citigroup (Rank#13), despite Saudi Arabia’s announcement to further reduce oil production, it is unlikely to lead to a sustained increase in oil prices to the high $80s-low $90s range. Citi’s analysis contradicts the views of other brokerages that have suggested a potential larger deficit in the oil market during the second half of the year, which could support higher prices.

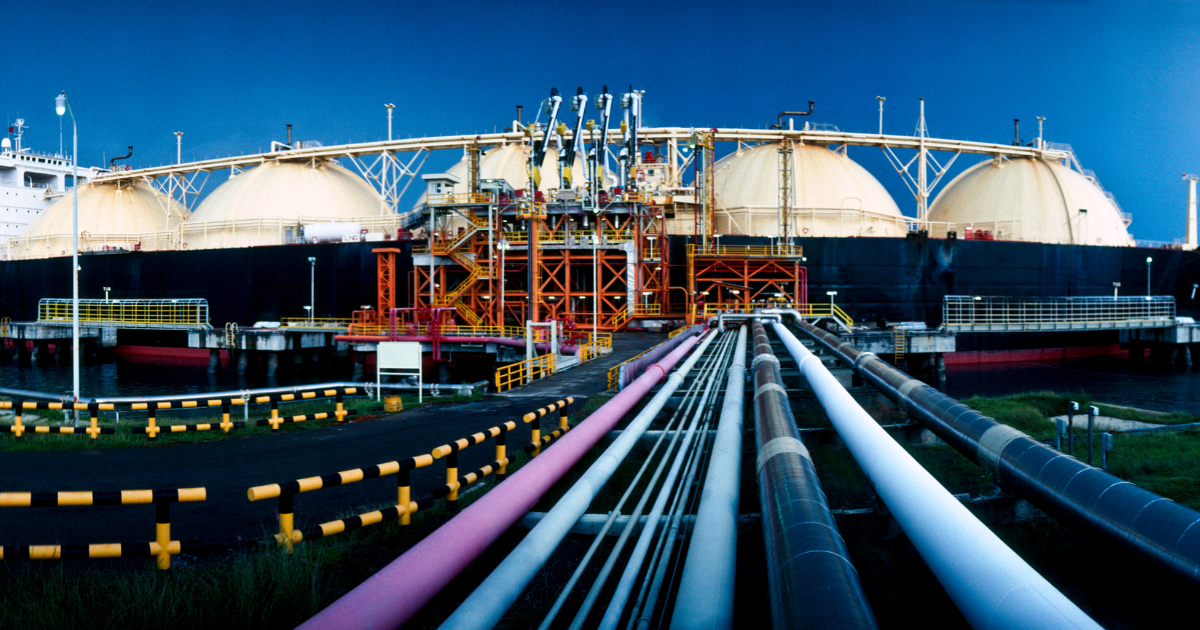

Saudi Arabia, as the world’s leading crude exporter, plays a significant role in influencing global oil prices. The country’s decision to deepen output cuts indicates its intention to limit the supply of oil in order to support prices. However, Citi’s note suggests that these efforts may not be sufficient to push prices significantly higher into the high $80s-low $90s range.

Citi likely considers several factors in its analysis. First, the note might take into account the current dynamics of global oil demand and supply. Despite the recovery in oil demand following the COVID-19 pandemic, there might be concerns about potential headwinds that could limit the magnitude of the price increase. Factors such as slower-than-expected global economic growth, ongoing geopolitical tensions, or the potential for increased production from other oil-producing nations could offset the impact of Saudi Arabia’s output cuts.

Secondly, Citi’s analysis may also consider the influence of other factors on oil prices, such as the ongoing transition to renewable energy sources and the global push for decarbonization. These factors could create long-term downward pressure on oil prices, limiting the potential for a sustained increase to the high $80s-low $90s range.

It’s important to note that Citi’s analysis represents its own perspective and differs from the views of other brokerages. Other analysts and institutions may have a more optimistic outlook on oil prices, suggesting a larger deficit in the oil market and potential for higher prices in the second half of the year.

Citigroup research indicates its skepticism about the ability of Saudi Arabia’s output cuts alone to drive oil prices to the high $80s-low $90s range. The analysis likely considers various factors impacting the oil market and highlights the complexity of predicting future price movements. The ultimate trajectory of oil prices will depend on a combination of global economic factors, geopolitical developments, and the ongoing transition to cleaner energy sources.