Investment opportunities in the drone industry have been on the rise due to the growing popularity of drones. One of the major players in this industry is DJI, which is the leading manufacturer of Phantom drones. In this article, we will provide you with a detailed guide on how to invest in Phantom drone stock and explore various aspects related to DJI’s market position.

An Overview of DJI Phantom:

DJI was founded in 2006 by aerospace engineer Frank Wang, starting in a humble garage. Despite its modest beginnings, the company’s innovative spirit helped it rise to great heights.

In 2012, DJI released the Phantom 1, the first consumer drone that was readily available for purchase and use. Today, DJI has firmly established itself as a dominant player in the drone industry, holding an impressive 76% share of the consumer drone market worldwide. This is a testament to the company’s popularity and reputation among consumers for being reliable and trustworthy. Moreover, DJI has seen remarkable growth in terms of financial success.

In 2018, the company was valued at an impressive $15 billion, and just three years later, in 2021, it reported a staggering revenue of $3.83 billion, further highlighting its continued success and market expansion.

How to Buy Phantom Drone Stock?

DJI, a leading drone manufacturer, is not currently available for public trading on stock exchanges. However, there are alternative methods to invest in the company and benefit from its success.

One way to indirectly participate in DJI’s success is to invest in exchange-traded funds (ETFs) or mutual funds that include DJI in their portfolio. Before making any investment decisions, it is important to conduct thorough research on the specific ETFs or mutual funds to understand their holdings, performance, and fees. Seeking the guidance of a financial advisor can also help make informed investment decisions.

Get access to the best stock analysis tools and insights with a free account today! Sign up!

Ownership of DJI Phantom Company:

DJI was founded by Frank Wang in 2006 and has attracted over $1 billion in investments. Notable investors include:

- Sequoia Capital China

- Accel

- Lighthouse Capital Management

- Brinc

- Kleiner Perkins

- Walden International

- Maison Capital

In addition to private investments, DJI has also received funding and support from both state-owned and partially state-owned companies and investment groups in China. A notable example of this is New China Life Insurance (NCI).

Indirect Approach to Invest in Phantom Drone Stock:

Retail investors who cannot invest directly in DJI stock still have opportunities to participate indirectly in DJI’s success through investing in ETFs or mutual funds that have exposure to DJI. These investment vehicles hold a diversified portfolio of stocks, including DJI, enabling investors to gain exposure to the company’s performance and potential growth.

However, it is essential to evaluate the performance, fees, and composition of these funds thoroughly before making any investment decisions. Additionally, conducting comprehensive research on the underlying holdings and the fund’s investment strategy will help investors better understand the level of exposure to DJI and the potential risks involved.

Analyzing the risks and rewards of investing in DJI Phantom:

Investing in DJI has its risks and rewards that investors need to carefully analyze. It is important to understand these factors to make an informed decision. The potential rewards of investing in DJI include the company’s dominant position in the drone industry, its impressive financial growth, and the projected industry growth. With a significant share of the consumer drone market and a history of innovation, DJI has the potential for further expansion and success, making it an attractive investment opportunity for those interested in the drone industry.

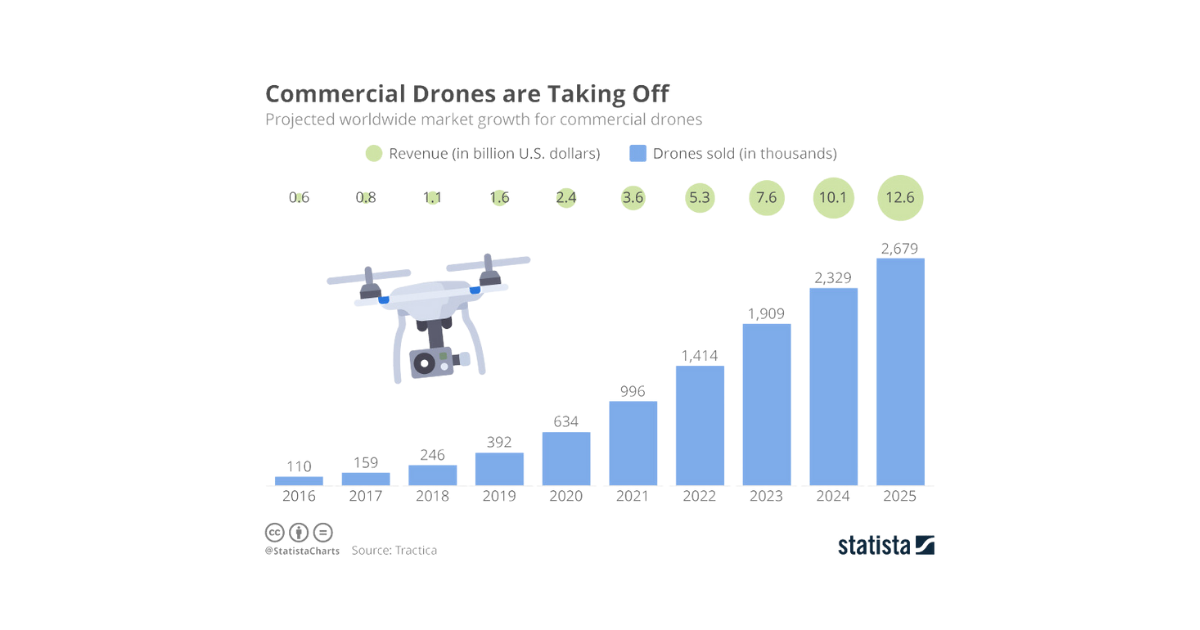

Commercial drones are taking off, with the global market projected to reach $12.6 billion by 2025. This growth is being driven by the increasing adoption of drones in a wide range of industries, including construction, agriculture, and delivery.

The attached graph from Statista shows the projected growth of the commercial drone market from 2016 to 2025. The graph shows that the number of drones sold is expected to increase from 159,000 in 2016 to 2,679,000 in 2025.

Conclusion:

Investing in Phantom drone stocks can be an attractive opportunity due to DJI’s strong market position and the projected expansion of the industry. However, it can also be challenging for retail investors, as DJI doesn’t have public trading. One way to invest in DJI is through indirect investment via ETFs or mutual funds, but this approach depends on the funds’ overall performance. By staying informed, assessing risks, and aligning investment strategies with financial goals, investors can participate in the exciting future of the drone industry.

FAQs

How can I invest in DJI Phantom drone stock in 2024?

DJI Phantom drone stock is not currently available for public trading, but you can indirectly invest in DJI’s success through exchange-traded funds (ETFs) or mutual funds that include DJI in their portfolio.

Can I invest in DJI Phantom drone stock through an online brokerage?

DJI Phantom drone stock is not available for public trading on stock exchanges, including online brokerages. However, you can consider investing indirectly through ETFs or mutual funds that include DJI in their portfolio.

Can I invest in DJI Phantom drone stock through an initial public offering (IPO)?

As of now, DJI has not conducted an initial public offering (IPO) to make its stock available for public trading. The company’s shares are not publicly traded on any stock exchanges.