Loblaw Companies Limited (L:CA), Canada’s largest retailer and food and pharmacy leader, is poised to release its highly anticipated quarterly earnings report.

Investors have been eagerly awaiting the Q4 2024 results, which are expected to shed light on the company’s continued resilience amid competitive pressures and inflationary challenges.

Before we dive in, we have a special offer! For a limited time, you can get 70% off Stock Target Advisor’s premium features. Claim your discount here!

Expected Quarterly Earning Report of Loblaw Companies Limited:

Loblaw is scheduled to announce its Q4 2024 results on February 20, 2025, at approximately 6:30 a.m. ET with a follow?up conference call at 10:00 a.m. ET. Analysts are forecasting an EPS in the range of 2.21 CAD per share, with revenue estimates hovering around 14.97 billion CAD for the quarter.

This outlook reflects expectations of modest sales growth and improved margins, driven by strategic investments in digital channels and new store openings, even as the company navigates headwinds such as inflation and shifting consumer behaviors.

Stock Target Advisor’s Analysis on Loblaw Companies Limited:

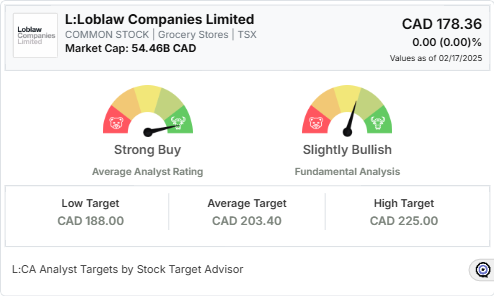

According to recent data from seven analysts, the average target price for Loblaw Companies Limited is CAD 203.40 over the next 12 months, with the average analyst rating at Strong Buy.

Stock Target Advisor’s own analysis is Slightly Bullish, supported by 10 positive signals and 7 negative signals. As of the latest closing, the stock was trading at CAD 178.36, reflecting a +0.21% change over the past week and a -3.00% change over the past month. Notably, Loblaw’s one-year capital gain is at 29.47%, placing it in the top percentile (100%) within its sector.

Analysts covering Loblaw maintain various target prices, from a low of CAD 188 to as high as CAD 225, reflecting differing outlooks on valuation. Most recent ratings include “Outperform” from CIBC World Markets, “Sector Perform” from Scotia Capital, and “Buy” from UBS.

Conclusion:

Loblaw Companies Limited’s upcoming Q4 2024 earnings preview presents an encouraging narrative for investors. The expected steady EPS growth and solid revenue performance, alongside continued strategic investments, reinforce Loblaw’s market leadership in the Canadian retail sector.

Investors will be closely monitoring the results for further clues on the company’s ability to sustain growth and manage rising operational costs in the coming quarters. With its Slightly Bullish outlook and top-tier dividend returns, Loblaw remains a key name to watch in the Grocery Stores space.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.