GameStop Corp (GME) stood out as one of the most active stocks on March 27, 2025, following a bold move to issue $1.3 billion in convertible senior notes to purchase Bitcoin.

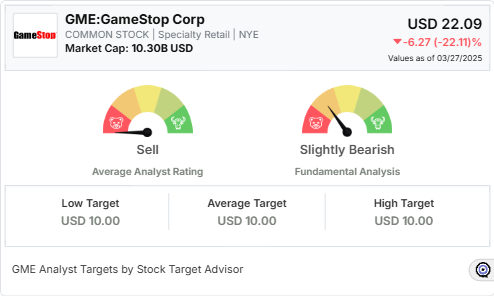

This controversial decision triggered a notable 22% drop in the stock’s value, closing at $22.09.

Why GME Was So Active:

Let’s break down the key factors that caused GameStop’s increased market activity.

1. Crypto Pivot:

The company’s pivot toward Bitcoin investments introduced uncertainty, raising questions about its long-term strategy.

2. Market Sentiment:

Analysts and investors reacted negatively, skeptical of the risks associated with cryptocurrency volatility.

3. Earnings Report:

Despite reporting a net income of $131.3 million in Q4, revenue saw a 30% decline, reflecting ongoing retail challenges.

Future Outlook and Analyst Predictions

Here’s what analysts are predicting for GameStop’s stock in the coming months.

1. Target Price

Analysts have set an average 12-month target price of $10, representing a potential downside of -54.73%.

2. Bearish Sentiment

GameStop has a “Sell” rating from analysts, with factors like high volatility, poor return on assets (0.1%), and weak revenue growth (-36.36% over five years) weighing heavily.

3. Sector Comparison

While GameStop has shown a 76.44% capital gain over the past year, it remains overpriced with a P/E ratio of 115.25, significantly above sector peers.

Ready to take your investments to the next level? For a limited time, get 70% off on Stock Target Advisor. Get started here!

Investor Takeaway:

GameStop’s decision to integrate Bitcoin into its financial strategy presents both opportunities and risks. Long-term investors should monitor market reactions, while short-term traders may capitalize on volatility. With a bearish outlook from analysts, caution is advised.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.