As trade tensions and energy policies evolve, Canadian pipeline giant Enbridge Inc (ENB:CA) faces growing challenges from U.S. tariffs on Canadian energy exports.

In April 2025, the U.S. President announced a 10% reciprocal tariff on imports from nearly all trading partners, signaling a potential shake-up in cross-border trade. However, under the U.S.-Mexico-Canada Agreement (USMCA), Canadian goods, including energy exports, remain exempt for now.

This exemption temporarily shields Enbridge, but the geopolitical risk has amplified investor concerns and placed pressure on future trade assumptions.

Before we dive in, we have a special offer! For a limited time, you can get 70% off Stock Target Advisor’s premium features. Claim your discount here!

U.S. Tariff Policy on Canadian Companies:

The U.S. has long maintained trade tariffs on various Canadian exports, including energy products, to balance trade deficits and ensure energy security. In 2024, increased tariffs on crude oil and natural gas imports created a ripple effect in the pipeline industry, with companies like Enbridge adjusting rates to remain competitive.

One of the most significant developments affecting Enbridge is the Trans Mountain Pipeline expansion (TMX), which began full operations in May 2024, increasing the flow of Canadian crude oil to the U.S. Gulf Coast.

In 2025, the newly announced reciprocal tariffs add another layer of complexity. While Enbridge’s exports are currently protected by USMCA, its CEO Greg Ebel acknowledged that if such tariffs were to apply in the long term, they would fundamentally reshape U.S.-Canada oil trade, a relationship responsible for around 4 million barrels per day.

Even the threat of future tariffs has accelerated Enbridge’s strategy to diversify and de-risk its business.

Read More: What Canadian Stocks Would Trump’s Tariffs Hit the Most?

Tariff Impacts on Enbridge’s Business Operations

Below are the Tariff Impacts on Enbridge’s Business Operations:

-

Pricing Pressure on Pipelines:

The expansion of TMX led to increased competition for crude shipments, pushing Enbridge to adjust tariffs across its network, particularly on the Mainline, Seaway, and Flanagan South pipelines.

Heavy crude shipments to the U.S. Gulf Coast saw tariff reductions, helping retain customers despite growing alternative routes.

2. Shifts in Supply Chain Economics:

Higher tariffs on Canadian energy exports have increased transportation costs, which could impact U.S. refiners reliant on Enbridge’s supply chain. Though USMCA exemptions remain intact, ongoing political developments introduce uncertainty.

Enbridge has leveraged its long-term contracts to mitigate immediate revenue losses, ensuring predictable cash flow despite tariff-induced pricing volatility.

3. Financial Performance Amid Tariff Pressures:

Despite these challenges, Enbridge’s core earnings for 2025 are projected to rise between CAD 19.4B and 20B, largely due to strong demand for oil and gas.

The company recently completed the USD 14B acquisition of Dominion Energy’s natural gas utilities, helping expand its market presence and buffer against pipeline tariff fluctuations.

Future Outlook for Enbridge & Tariff Impact:

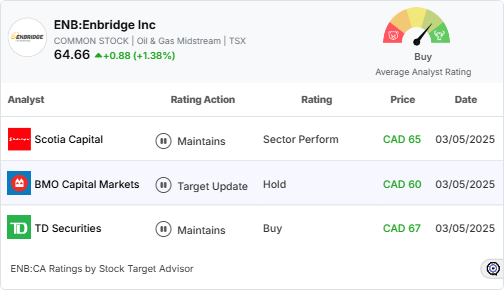

Stock Target Advisor provides insights into Enbridge Inc.’s market performance based on the analysis of 13 analysts covering. The average target price for the stock is CAD 61.94, reflecting a mix of ratings and perspectives.

Global oil demand continues to rise, expected to hit all-time highs in 2025. Canadian oil production is forecast to increase by 500,000 bpd in 2025, likely filling up available pipeline space.

Enbridge’s long-term investments in natural gas and renewables help buffer against tariff-related losses in crude oil transport.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.