Global Markets

Canadian Markets

Canada’s main stock index traded mixed as strength in mining shares helped offset weakness in other sectors, while new inflation data largely met market expectations. Canada’s annual inflation rate held steady at 2.2 per cent in November, according to Statistics Canada, coming in slightly below consensus forecasts from CIBC Economics, which had anticipated a modest uptick to 2.3 per cent. Economists widely interpreted the November Consumer Price Index reading as consistent with the Bank of Canada’s current policy stance and unlikely to alter its recent guidance. With inflation tracking close to target, the central bank is expected to maintain its cautious holding pattern on interest rates, barring a material shift in economic conditions.

American Markets

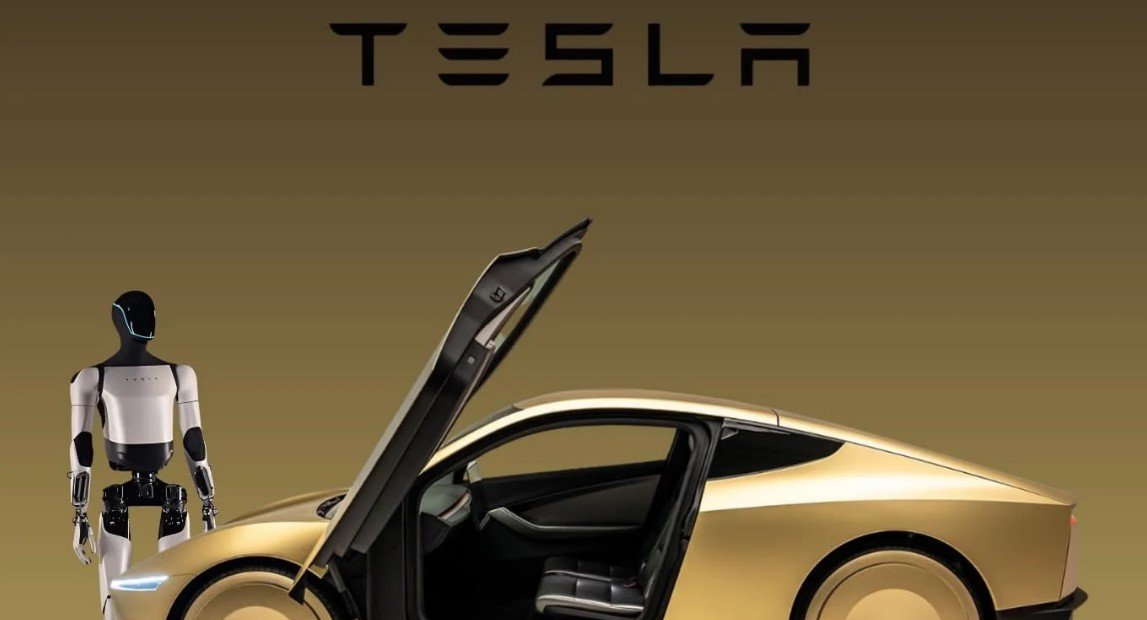

US stocks moved lower as falling oil prices and a more defensive market tone weighed on sentiment. Bitcoin declined more than two per cent, reinforcing a broader risk-off environment across speculative assets. However, Tesla shares bucked the broader trend, rising sharply following renewed investor optimism around the early stages of the company’s robo-taxi rollout, which analysts view as a potential long-term growth catalyst.

Despite near-term volatility, some market strategists suggest equities may be approaching a technical inflection point, with several major indices nearing levels that could support a breakout before year end.

European Markets

In Europe, markets traded higher after euro zone industrial output growth accelerated in October, strengthening the narrative that economic momentum is gradually improving. Easing trade uncertainty, a tight labour market, and incremental gains in consumer spending have supported this more constructive outlook.

UK stocks also moved higher ahead of the Bank of England’s upcoming policy meeting, where traders widely expect a rate cut to 3.75 per cent from 4.0 per cent. Such a move would mark the first reduction since August and lower borrowing costs to their lowest level in three years. Expectations of looser monetary policy have provided support to UK equities, particularly interest-rate-sensitive sectors, as investors position for an easing cycle heading into the new year.

Corporate Stock News

Airbnb Inc. (ABNB) was fined $75 million by Spain’s Consumer Rights Ministry for advertising unlicensed tourist rentals, as authorities intensify efforts to address housing shortages linked to short-term rental platforms.

Alta Copper Corp. (ALTA:CA) agreed to be fully acquired by Fortescue, which offered C$1.40 per share to buy the remaining 64% stake it does not own, valuing the copper miner at C$139 million amid strong long-term copper demand.

Baldwin Insurance Group Inc. (BWIN) had its price target raised to $28 from $26 by Jefferies following updated earnings projections tied to the completion of its merger with CAC Group.

Berkshire Hathaway Inc. (BRK.B) confirmed that Greg Abel will succeed Warren Buffett as CEO, formalizing a long-anticipated leadership transition while Buffett remains chairman.

Coca-Cola Co. (KO) is holding last-ditch negotiations with TDR Capital to salvage the proposed sale of Costa Coffee after talks reportedly stalled over valuation concerns.

Dollar General Corp. (DG) had its price target raised to $166 from $128 by JPMorgan, supported by merchandising improvements and potential macro tailwinds.

Equinox Gold Corp. (EQX:CA) announced plans to sell multiple Latin American gold assets to China’s CMOC for $1.015 billion, subject to regulatory approvals in Brazil and China.

Fastenal Co. (FAST) was upgraded to Buy from Hold by Jefferies, citing renewed confidence in market share gains and sustained top-line growth into 2026.

FMC Corp. (FMC) approved a restructuring plan aimed at cutting costs and shifting production to lower-cost regions, targeting at least $175 million in annual savings by 2027.

Fortuna Mining Corp. (FVI:CA) said it is pursuing mid-tier gold acquisitions and accelerating project development as it works to restore annual production to 500,000 ounces following recent asset sales.

Imperial Oil Ltd. (IMO:CA) issued a fire alert at its Sarnia, Ontario refinery, activating emergency systems while personnel responded to the incident. BMO Capital Markets downgraded the Canadian producer, cutting the rating to “Market perform” from “Outperform,” and also cutting the 12 month target price to $129 from $132.

iRobot Corp. (IRBT) filed for Chapter 11 bankruptcy protection and agreed to go private under an acquisition by Picea Robotics, citing competitive pressures and tariff-related challenges.

Keurig Dr Pepper Inc. (KDP) had its price target raised to $38 from $35 by Piper Sandler on expectations of future tariff relief on coffee imports.

Kraft Heinz Co. (KHC) saw its price target increased to $27 from $25 at Piper Sandler, reflecting expectations for potential tariff-related price rollbacks.

Nvidia Corp. (NVDA) is evaluating additional production capacity for its H200 AI chips after demand from Chinese customers exceeded current supply following renewed export approvals.

ServiceNow Inc. (NOW) is reportedly in advanced talks to acquire cybersecurity firm Armis for up to $7 billion, potentially pre-empting Armis’s planned IPO.

Strategy Inc. (MSTR) retained its position in the Nasdaq 100, though analysts continue to question the sustainability of its bitcoin-centric treasury strategy.

Tesla Inc. (TSLA) disclosed that its board of directors has earned more than $3 billion in stock-based compensation over time. Tesla’s stock jumped as Musk confirms the company is testing driverless Robotaxis.

STA Research (StockTargetAdvisor.com) is a independent Investment Research company that specializes in stock forecasting and analysis with integrated AI, based on our platform stocktargetadvisor.com, EST 2007.

Thanks for helping out, great info .

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

Thanks for each of your labor on this web page. Ellie really loves carrying out investigation and it’s really simple to grasp why. My spouse and i notice all of the lively form you present insightful steps on your web blog and as well as inspire contribution from people about this matter so our own princess is understanding a lot. Enjoy the rest of the new year. Your doing a remarkable job.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Hello! Someone in my Myspace group shared this website with us so I came to take a look. I’m definitely loving the information. I’m bookmarking and will be tweeting this to my followers! Fantastic blog and amazing design and style.

Just a smiling visitant here to share the love (:, btw great pattern. “Make the most of your regrets… . To regret deeply is to live afresh.” by Henry David Thoreau.

Great awesome things here. I?¦m very happy to see your article. Thank you a lot and i’m looking ahead to touch you. Will you kindly drop me a mail?

Its such as you read my mind! You appear to understand a lot about this, such as you wrote the book in it or something. I believe that you simply can do with a few percent to power the message home a bit, however other than that, that is wonderful blog. A fantastic read. I will certainly be back.

I not to mention my buddies ended up reading through the great things located on your web site and then the sudden got a horrible suspicion I never thanked the web blog owner for those techniques. All the boys were for that reason excited to study all of them and have clearly been having fun with these things. I appreciate you for simply being indeed accommodating and also for obtaining variety of helpful ideas most people are really wanting to discover. My very own honest regret for not expressing appreciation to you sooner.

You have remarked very interesting points! ps decent web site.

You could definitely see your enthusiasm in the paintings you write. The arena hopes for even more passionate writers such as you who aren’t afraid to say how they believe. Always go after your heart.

Outstanding post, you have pointed out some superb points, I too believe this s a very superb website.

My brother recommended I might like this web site. He was totally right. This post truly made my day. You can not imagine simply how much time I had spent for this information! Thanks!

I haven’t checked in here for a while because I thought it was getting boring, but the last few posts are good quality so I guess I’ll add you back to my everyday bloglist. You deserve it my friend 🙂

I’m really inspired together with your writing talents and also with the format in your blog. Is this a paid topic or did you customize it yourself? Anyway keep up the nice quality writing, it is uncommon to peer a great weblog like this one today..

Some genuinely interesting information, well written and loosely user genial.

I am always browsing online for posts that can benefit me. Thanks!

I do agree with all the ideas you’ve presented in your post. They are really convincing and will certainly work. Still, the posts are too short for beginners. Could you please extend them a bit from next time? Thanks for the post.

Hey are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and set up my own. Do you require any html coding knowledge to make your own blog? Any help would be really appreciated!

obviously like your web-site but you have to check the spelling on quite a few of your posts. Many of them are rife with spelling problems and I in finding it very bothersome to inform the reality nevertheless I¦ll certainly come again again.

Some really fantastic info , Gladiolus I detected this.

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is valuable and everything. Nevertheless think of if you added some great graphics or video clips to give your posts more, “pop”! Your content is excellent but with pics and clips, this blog could definitely be one of the greatest in its niche. Amazing blog!

Hello. fantastic job. I did not imagine this. This is a remarkable story. Thanks!

I really wanted to send a brief comment to be able to appreciate you for the remarkable advice you are giving out at this site. My rather long internet research has now been paid with extremely good content to talk about with my relatives. I would mention that we website visitors are extremely lucky to live in a fantastic website with many perfect individuals with useful advice. I feel pretty fortunate to have encountered your entire website and look forward to plenty of more fun minutes reading here. Thanks once more for all the details.

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

Loving the info on this website , you have done outstanding job on the posts.

The very heart of your writing whilst sounding agreeable at first, did not work well with me after some time. Someplace throughout the sentences you actually were able to make me a believer but only for a very short while. I nevertheless have got a problem with your leaps in logic and you would do nicely to help fill in those gaps. If you can accomplish that, I will undoubtedly be fascinated.

I like this post, enjoyed this one thanks for putting up.

I like what you guys are up too. Such smart work and reporting! Keep up the superb works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my web site 🙂

naturally like your web site but you have to check the spelling on several of your posts. Several of them are rife with spelling issues and I find it very troublesome to tell the truth nevertheless I will certainly come back again.

Hello, Neat post. There is an issue along with your website in internet explorer, would check this… IE nonetheless is the market chief and a big element of other folks will omit your magnificent writing because of this problem.

Hey there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Hmm it appears like your website ate my first comment (it was super long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog. I too am an aspiring blog writer but I’m still new to the whole thing. Do you have any tips and hints for beginner blog writers? I’d definitely appreciate it.

I have been absent for a while, but now I remember why I used to love this blog. Thanks, I will try and check back more frequently. How frequently you update your website?

Thank you for another magnificent article. Where else could anybody get that type of information in such an ideal way of writing? I have a presentation next week, and I am on the look for such info.

I really like your writing style, wonderful info, thanks for putting up :D. “Freedom is the emancipation from the arbitrary rule of other men.” by Mortimer Adler.

Hello. splendid job. I did not imagine this. This is a fantastic story. Thanks!

Thank you for another magnificent article. Where else could anybody get that kind of info in such an ideal way of writing? I’ve a presentation next week, and I’m on the look for such info.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

Thanks for helping out, superb information.

I was just looking for this information for a while. After six hours of continuous Googleing, at last I got it in your site. I wonder what is the lack of Google strategy that don’t rank this type of informative web sites in top of the list. Usually the top websites are full of garbage.

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thank you again

I’m curious to find out what blog system you’re using? I’m having some minor security problems with my latest site and I’d like to find something more safe. Do you have any recommendations?

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

Great post however I was wondering if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit further. Kudos!

I like this site very much, Its a real nice berth to read and get information.

After research just a few of the blog posts on your website now, and I actually like your method of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as nicely and let me know what you think.

Its fantastic as your other blog posts : D, appreciate it for putting up. “Before borrowing money from a friend it’s best to decide which you need most.” by Joe Moore.

It?¦s truly a great and useful piece of info. I?¦m happy that you just shared this useful info with us. Please stay us informed like this. Thank you for sharing.

Wow that was unusual. I just wrote an very long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Anyway, just wanted to say wonderful blog!

I do agree with all of the ideas you have presented in your post. They’re very convincing and will certainly work. Still, the posts are very short for novices. Could you please extend them a bit from next time? Thanks for the post.

hi!,I like your writing so much! share we communicate more about your post on AOL? I need an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

You made some nice points there. I did a search on the subject matter and found most individuals will agree with your site.

I’ve been absent for some time, but now I remember why I used to love this web site. Thanks , I’ll try and check back more frequently. How frequently you update your site?

Its like you read my mind! You appear to know a lot about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a bit, but instead of that, this is wonderful blog. A great read. I’ll certainly be back.

Thank you for another informative site. Where else could I get that type of info written in such an ideal way? I have a project that I’m just now working on, and I have been on the look out for such info.

Some truly choice blog posts on this site, bookmarked.

Of course, what a splendid blog and revealing posts, I surely will bookmark your website.Best Regards!

I was wondering if you ever considered changing the structure of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or two images. Maybe you could space it out better?

Only wanna input on few general things, The website pattern is perfect, the written content is rattling good. “War is much too serious a matter to be entrusted to the military.” by Georges Clemenceau.

I keep listening to the reports talk about getting boundless online grant applications so I have been looking around for the most excellent site to get one. Could you advise me please, where could i acquire some?

USA Flights 24 — search engine helps you compare prices from hundreds of airlines and travel sites in seconds — so you can find cheap flights fast. Whether you’re planning a weekend getaway, a cross-country adventure, or an international vacation, we make it easy to fly for less.

Thanks for sharing superb informations. Your website is very cool. I am impressed by the details that you’ve on this website. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for extra articles. You, my pal, ROCK! I found just the info I already searched all over the place and simply couldn’t come across. What a great web-site.

Wow, amazing weblog format! How long have you been blogging for? you made running a blog look easy. The whole glance of your site is magnificent, as well as the content material!

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

My partner and I stumbled over here from a different web page and thought I may as well check things out. I like what I see so i am just following you. Look forward to looking over your web page again.

I like this post, enjoyed this one thankyou for putting up.

Hello! I’ve been reading your site for a while now and finally got the bravery to go ahead and give you a shout out from Humble Tx! Just wanted to say keep up the excellent job!

Great site. A lot of useful information here. I’m sending it to a few friends ans also sharing in delicious. And naturally, thanks for your effort!

Very interesting information!Perfect just what I was searching for! “To see what is right, and not to do it, is want of courage or of principle.” by Lisa Alther.

Hey, you used to write great, but the last several posts have been kinda boring… I miss your tremendous writings. Past several posts are just a little out of track! come on!

Deference to post author, some good entropy.

Aw, this was a really nice post. In thought I wish to put in writing like this moreover – taking time and actual effort to make a very good article… however what can I say… I procrastinate alot and not at all appear to get something done.

Hi there! I could have sworn I’ve been to this blog before but after checking through some of the post I realized it’s new to me. Anyhow, I’m definitely delighted I found it and I’ll be bookmarking and checking back often!

I have learn several excellent stuff here. Certainly value bookmarking for revisiting. I surprise how so much effort you place to make one of these excellent informative website.

There are some fascinating points in time in this article but I don’t know if I see all of them center to heart. There’s some validity but I’ll take hold opinion until I look into it further. Good article , thanks and we want more! Added to FeedBurner as well

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say fantastic blog!

Great blog! Do you have any recommendations for aspiring writers? I’m planning to start my own blog soon but I’m a little lost on everything. Would you propose starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m totally overwhelmed .. Any recommendations? Appreciate it!

Wow, wonderful weblog layout! How lengthy have you ever been blogging for? you made running a blog glance easy. The whole look of your website is wonderful, as smartly as the content!

F*ckin’ awesome issues here. I am very satisfied to peer your article. Thanks a lot and i’m having a look forward to touch you. Will you kindly drop me a e-mail?

Wow that was strange. I just wrote an extremely long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say fantastic blog!

I went over this website and I believe you have a lot of fantastic information, saved to favorites (:.

Thanks so much for providing individuals with an extremely spectacular chance to read from here. It really is very pleasing and full of a lot of fun for me and my office peers to visit your blog at the very least thrice every week to see the fresh stuff you have. Of course, I’m just always fulfilled with all the gorgeous methods you give. Certain 1 ideas in this article are ultimately the most beneficial we have had.

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

I do accept as true with all of the ideas you’ve introduced to your post. They are really convincing and will definitely work. Still, the posts are very short for novices. May just you please extend them a bit from next time? Thank you for the post.

What i don’t understood is in truth how you’re no longer actually a lot more neatly-liked than you might be right now. You are so intelligent. You know thus significantly in relation to this subject, produced me in my view imagine it from so many numerous angles. Its like women and men don’t seem to be involved until it¦s something to do with Lady gaga! Your individual stuffs outstanding. At all times handle it up!

Undeniably believe that which you said. Your favorite justification seemed to be on the web the simplest thing to be aware of. I say to you, I definitely get irked while people think about worries that they plainly don’t know about. You managed to hit the nail upon the top and also defined out the whole thing without having side effect , people can take a signal. Will probably be back to get more. Thanks

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

Thanks for sharing superb informations. Your web-site is very cool. I am impressed by the details that you have on this site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for extra articles. You, my pal, ROCK! I found just the info I already searched everywhere and simply couldn’t come across. What an ideal site.

This really answered my problem, thank you!

Some truly nice and useful information on this website, likewise I believe the style has good features.

Spot on with this write-up, I really think this website needs way more consideration. I’ll in all probability be once more to read much more, thanks for that info.

Hiya, I am really glad I’ve found this information. Today bloggers publish just about gossips and net and this is really annoying. A good web site with interesting content, this is what I need. Thank you for keeping this site, I will be visiting it. Do you do newsletters? Can’t find it.

I’d always want to be update on new content on this site, saved to my bookmarks! .

I like what you guys are up too. Such smart work and reporting! Keep up the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my site 🙂

It is truly a great and useful piece of information. I’m glad that you shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

bingoplus ph refers to the Philippine-facing version of Bingo Plus, tailored for users located in the Philippines.

There are definitely numerous details like that to take into consideration. That could be a nice level to bring up. I provide the ideas above as normal inspiration however clearly there are questions like the one you deliver up the place an important thing will probably be working in trustworthy good faith. I don?t know if finest practices have emerged around issues like that, however I am certain that your job is clearly identified as a good game. Each girls and boys feel the affect of just a moment’s pleasure, for the remainder of their lives.

My coder is trying to convince me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using Movable-type on numerous websites for about a year and am anxious about switching to another platform. I have heard good things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be greatly appreciated!

I like this web blog very much, Its a really nice office to read and obtain information. “‘Taint’t worthwhile to wear a day all out before it comes.” by Sarah Orne Jewett.

You could certainly see your enthusiasm within the paintings you write. The world hopes for even more passionate writers such as you who aren’t afraid to mention how they believe. At all times follow your heart.

I¦ve been exploring for a bit for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I eventually stumbled upon this web site. Reading this information So i am satisfied to express that I have an incredibly good uncanny feeling I found out just what I needed. I most certainly will make sure to don¦t put out of your mind this site and provides it a glance regularly.

I have been examinating out some of your stories and i can claim nice stuff. I will surely bookmark your blog.

I like this post, enjoyed this one appreciate it for putting up. “Pain is inevitable. Suffering is optional.” by M. Kathleen Casey.

Keep functioning ,terrific job!

Real fantastic info can be found on website. “Life without a friend is death without a witness.” by Eugene Benge.

I have been absent for a while, but now I remember why I used to love this blog. Thank you, I’ll try and check back more often. How frequently you update your web site?

Really excellent visual appeal on this internet site, I’d value it 10 10.

I don’t normally comment but I gotta admit appreciate it for the post on this great one : D.

Thank you for sharing excellent informations. Your web site is so cool. I am impressed by the details that you¦ve on this web site. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found just the information I already searched all over the place and just couldn’t come across. What an ideal site.

Some genuinely nice stuff on this internet site, I love it.

You really make it seem so easy with your presentation but I find this matter to be really something which I think I would never understand. It seems too complicated and extremely broad for me. I am looking forward for your next post, I will try to get the hang of it!

Thanks for every other informative blog. Where else could I am getting that kind of info written in such an ideal manner? I’ve a venture that I’m just now operating on, and I’ve been at the look out for such information.

Very nice design and style and excellent subject material, absolutely nothing else we want : D.

Hello this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding skills so I wanted to get advice from someone with experience. Any help would be enormously appreciated!

I regard something truly special in this website.

I’ve read a few good stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you put to create such a excellent informative site.

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Wow! Thank you! I permanently needed to write on my website something like that. Can I take a portion of your post to my site?

obviously like your web-site however you have to test the spelling on quite a few of your posts. Several of them are rife with spelling problems and I find it very troublesome to tell the truth then again I’ll definitely come back again.

Pretty nice post. I just stumbled upon your blog and wanted to say that I have really enjoyed browsing your blog posts. After all I’ll be subscribing to your feed and I hope you write again soon!

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

This is very interesting, You are a very skilled blogger. I have joined your rss feed and look forward to seeking more of your wonderful post. Also, I’ve shared your site in my social networks!

Hey there! I’m at work surfing around your blog from my new iphone 3gs! Just wanted to say I love reading through your blog and look forward to all your posts! Keep up the great work!

I like what you guys are up also. Such intelligent work and reporting! Carry on the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my web site :).

Rattling informative and great structure of articles, now that’s user pleasant (:.

Im now not sure the place you are getting your information, however great topic. I must spend some time studying more or figuring out more. Thank you for fantastic info I used to be on the lookout for this info for my mission.

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

Hello there, just changed into alert to your weblog through Google, and found that it is really informative. I am going to be careful for brussels. I’ll be grateful in the event you continue this in future. Lots of people will be benefited from your writing. Cheers!

Thanks for all of your effort on this website. Debby take interest in participating in investigation and it is obvious why. My spouse and i notice all concerning the powerful medium you convey very useful tactics through this website and in addition invigorate participation from other individuals on that content then our child is without a doubt discovering so much. Enjoy the remaining portion of the year. You have been doing a fabulous job.

I just couldn’t leave your site prior to suggesting that I really enjoyed the standard information an individual provide to your visitors? Is going to be again frequently to inspect new posts.

Excellent weblog here! Additionally your web site rather a lot up very fast! What host are you the usage of? Can I get your affiliate hyperlink to your host? I desire my website loaded up as fast as yours lol

Very interesting information!Perfect just what I was searching for!

Hey there! This is my first comment here so I just wanted to give a quick shout out and say I truly enjoy reading through your posts. Can you recommend any other blogs/websites/forums that go over the same topics? Thanks!

That is the precise blog for anybody who wants to seek out out about this topic. You realize a lot its nearly onerous to argue with you (not that I truly would need…HaHa). You definitely put a brand new spin on a topic thats been written about for years. Great stuff, just nice!

A person essentially help to make seriously posts I would state. This is the very first time I frequented your web page and thus far? I amazed with the research you made to make this particular publish extraordinary. Excellent job!

Somebody essentially help to make seriously articles I would state. This is the first time I frequented your web page and thus far? I amazed with the research you made to create this particular publish amazing. Great job!

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you can do with some pics to drive the message home a little bit, but instead of that, this is great blog. A great read. I will certainly be back.

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

I also believe therefore, perfectly indited post! .

My wife and i were really satisfied that Jordan could conclude his web research using the ideas he got through your site. It’s not at all simplistic to simply happen to be giving away instructions which often a number of people might have been trying to sell. Therefore we do know we need the writer to be grateful to for that. The explanations you made, the simple web site menu, the relationships you make it easier to create – it is many overwhelming, and it’s really aiding our son in addition to the family imagine that the subject matter is pleasurable, which is certainly exceedingly mandatory. Thank you for everything!

Nice post. I learn something tougher on different blogs everyday. It’ll always be stimulating to learn content material from different writers and follow slightly something from their store. I’d favor to make use of some with the content on my blog whether you don’t mind. Natually I’ll give you a link in your web blog. Thanks for sharing.

Hello, Neat post. There is an issue with your site in internet explorer, may check this… IE still is the market leader and a huge element of people will pass over your magnificent writing because of this problem.

Some really interesting information, well written and broadly speaking user genial.

After I initially commented I clicked the -Notify me when new comments are added- checkbox and now each time a remark is added I get four emails with the same comment. Is there any means you can remove me from that service? Thanks!

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

I would like to voice my respect for your kindness for individuals that absolutely need assistance with this content. Your very own commitment to passing the solution all-around appeared to be wonderfully productive and have regularly helped girls much like me to attain their pursuits. This useful guideline entails a whole lot a person like me and a whole lot more to my mates. Many thanks; from all of us.

I do agree with all of the ideas you have presented in your post. They are very convincing and will definitely work. Still, the posts are too short for newbies. Could you please extend them a bit from next time? Thanks for the post.

I am glad to be a visitant of this utter web blog! , thankyou for this rare information! .

I was curious if you ever thought of changing the structure of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or 2 pictures. Maybe you could space it out better?

Some truly nice and utilitarian info on this website , as well I conceive the pattern holds fantastic features.

Pretty element of content. I simply stumbled upon your website and in accession capital to assert that I get in fact loved account your blog posts. Anyway I will be subscribing to your augment or even I achievement you get right of entry to consistently rapidly.

You could definitely see your enthusiasm in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always go after your heart.

I like the helpful information you provide in your articles. I’ll bookmark your weblog and check again here frequently. I am quite sure I will learn many new stuff right here! Good luck for the next!

A powerful share, I simply given this onto a colleague who was doing a little evaluation on this. And he in actual fact bought me breakfast as a result of I found it for him.. smile. So let me reword that: Thnx for the deal with! But yeah Thnkx for spending the time to discuss this, I really feel strongly about it and love reading more on this topic. If doable, as you grow to be experience, would you thoughts updating your blog with more particulars? It’s highly useful for me. Massive thumb up for this blog post!

Very interesting topic, appreciate it for posting. “Remember when life’s path is steep to keep your mind even.” by Horace.

My programmer is trying to convince me to move to .net from PHP. I have always disliked the idea because of the costs. But he’s tryiong none the less. I’ve been using Movable-type on various websites for about a year and am worried about switching to another platform. I have heard very good things about blogengine.net. Is there a way I can import all my wordpress content into it? Any kind of help would be greatly appreciated!

I got what you intend,saved to bookmarks, very decent website .

Howdy! Do you use Twitter? I’d like to follow you if that would be ok. I’m definitely enjoying your blog and look forward to new posts.

I was recommended this blog by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my trouble. You are incredible! Thanks!

Some times its a pain in the ass to read what website owners wrote but this site is rattling user friendly! .

Thanks a lot for sharing this with all of us you actually know what you are talking about! Bookmarked. Kindly also visit my web site =). We could have a link exchange arrangement between us!

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

hi!,I really like your writing very so much! share we communicate more about your post on AOL? I need an expert in this house to unravel my problem. Maybe that’s you! Having a look forward to see you.

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.