In April 2025, the U.S. government announced sweeping new tariffs on Chinese imports, marking a major escalation in global trade tensions. The tariffs include a baseline 125% hike, with an additional 20% levy on fentanyl-linked products, bringing the total up to 145% on certain goods.

In retaliation, China announced tariffs up to 84% on a wide range of U.S. exports. This escalating tariff war has sent ripples across global markets and raises critical questions about its impact on international companies, particularly Methanex Corporation (MX:CA), a global leader in methanol production.

Tariff Implications on Methanex Corporation:

Methanex operates in a globally interconnected industry, and its fortunes are closely tied to macroeconomic trends and international trade flows.

The company supplies methanol across key regions, including North America, Asia Pacific, Europe, and South America, with China alone representing nearly 60% of global methanol consumption.

- Disruption in global supply chains, making it more difficult and costly to deliver products to Asian markets.

- Reduced demand growth in China, Methanex’s largest market, due to increased import costs and slower industrial activity.

- Volatility in feedstock pricing and logistics, pressuring margins and possibly delaying expansion plans.

Moreover, higher trade barriers may discourage capital expenditure and foreign investment in petrochemical-heavy regions, posing a long-term threat to Methanex’s growth outlook.

Stock Target Advisor’s Analysis on Methanex Corporation:

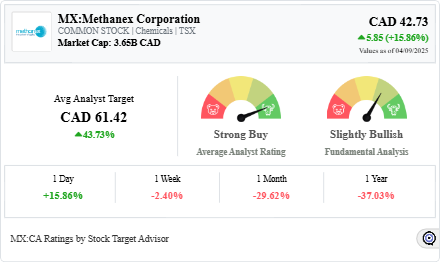

Based on a consensus of 6 analysts, Methanex Corporation (MX:CA) currently holds an average target price of CAD 61.42 over the next 12 months, with an average rating of Strong Buy. However, Stock Target Advisor’s independent assessment is Slightly Bullish, based on 6 positive signals and 3 negative ones.

Recent Analyst Ratings:

- Piper Jaffray Companies – Neutral, Target: CAD 51

- Jefferies & Company – Buy, Target: CAD 49

- UBS – Buy, Target: CAD 53

- CIBC World Markets – Buy, Target: CAD 55

Conclusion:

Methanex Corporation finds itself at the intersection of a deepening U.S.-China trade conflict. While its long-term fundamentals remain strong, supported by high dividend growth and a solid global footprint, the near-term risks tied to demand shifts, pricing pressure, and macroeconomic uncertainty cannot be ignored.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.