The ongoing trade tensions between the United States and Canada have put several U.S. companies at risk. With Canada now considering new tariff measures in response to recent U.S. proposals, including President Trump’s suggestion of 25 percent tariffs on auto, chip, and pharmaceutical imports, key sectors such as consumer goods, construction, and energy could face higher costs and reduced market access.

Below we analyze three U.S. stocks, Molson Coors Beverage Company, DR Horton Inc, and Enbridge Inc, that could suffer due to Canadian tariffs, with updated insights and Stock Target Advisor’s analysis.

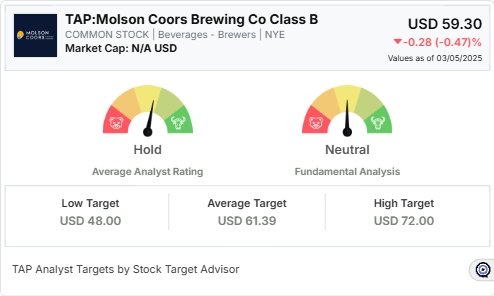

1. Molson Coors Beverage Company:

- Molson Coors Beverage Company, one of the largest beverage manufacturers in North America, relies on cross-border trade for ingredients and finished products.

- Tariffs on beer imports or agricultural products such as barley and aluminum, used in packaging, could raise costs.

- Higher costs may force the company to absorb expenses or pass them on to consumers, potentially disrupting its supply chain and compressing margins

Read More: How Steel and Aluminum Tariffs Affect U.S. Companies

Impact of Canadian Tariffs

Molson Coors is vulnerable to tariffs on aluminum cans, packaging materials, and brewing ingredients, factors that may disrupt supply chains and squeeze profit margins, potentially impacting stock performance

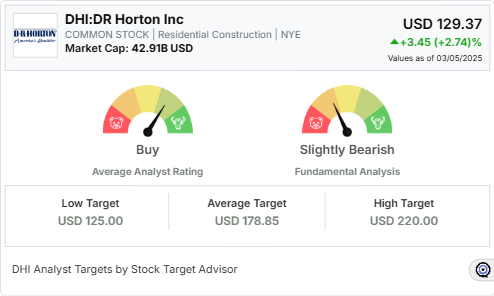

2. DR Horton Inc:

- DR Horton Inc, a leading U.S. home construction company, already faces inflationary pressures in the building materials market.

- Canada is a key supplier of softwood lumber, and past disputes have affected the sector.

- New tariff measures may drive up lumber and other building material costs, further increasing housing costs and reducing affordability for consumers, which could weaken demand and hurt profitability.

Read More: Tariff Effects on Major U.S. Sectors

Impact of Canadian Tariffs:

Higher costs for essential building materials could slow down new home construction and further elevate housing costs, impacting DR Horton Inc’s revenue growth and profitability.

3. Enbridge Inc:

- Enbridge Inc, one of North America’s largest pipeline operators, depends on the smooth cross-border flow of oil and gas between Canada and the United States.

- New trade developments raise the possibility that Canada may introduce broader tariffs on energy transportation services.

- This could reduce export demand and complicate regulatory compliance for Enbridge, affecting its revenue stream

Read More: Tariff Effects on Enbridge and the Energy Sector

Impact of Canadian Tariffs

Additional tariffs or broadened tariff frameworks on energy transportation could reduce Enbridge Inc’s revenues, increase regulatory hurdles, and lower investor confidence, further straining its financial outlook.

Conclusion:

With trade tensions rising, investors should closely monitor stocks exposed to Canadian tariffs. Companies in consumer goods, housing, and energy are particularly vulnerable, as tariffs could increase operating costs and reduce demand. Diversification and risk management strategies may help mitigate potential losses.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.