The recent announcement of sweeping reciprocal tariffs by the U.S. President has reignited concerns over global trade dynamics, particularly in resource-heavy sectors like mining.

As part of this policy, the U.S. is imposing a blanket 10% tariff on all imports, with higher rates targeting specific countries. While Canada has largely been exempted, the indirect implications are significant for Canadian mining firms with global supply chains and export markets.

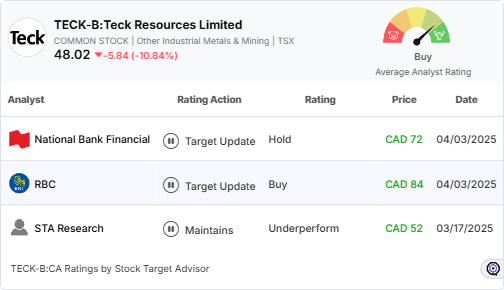

Teck Resources Limited (TECK-B:CA), one of Canada’s largest mining companies, finds itself in the crosshairs of this trade recalibration. With operations deeply tied to global commodity markets, Teck is reassessing its export strategies, managing volatility, and responding to shifting investor sentiment.

This article examines how these trade developments are affecting Teck’s performance and future outlook.

Implications for Canadian Mining:

In response to the latest tariff threats, Teck has proactively developed contingency plans to shift refined zinc exports to Asian markets, reserving port capacity and warehousing space. CEO Jonathan Price emphasized that these changes were designed to insulate the company from U.S. policy unpredictability.

Despite global volatility, Teck expects no material impact to its financial results due to these efforts.

Market Analyst Coverage on Teck Resources:

- RBC: Buy (Target Price: CAD 84)

- National Bank Financial: Hold (Target Price: CAD 72)

- STA Research: Underperform (Target Price: CAD 52)

- Morningstar: Buy (Target Price: CAD 34)

- Scotia Capital: Outperform (Target Price: CAD 73)

Analysts present a mixed outlook, with some rating Teck favorably despite trade uncertainties, while others signal caution due to tariff risks.

Stock Target Advisor’s Analysis on Teck Resources Limited:

Stock Target Advisor has given Teck Resources a “Slightly Bullish” rating based on 9 positive signals and 6 negative signals. Their target price of CAD 67.59 represents a projected 40% increase over the next 12 months.

What We Like:

- High market capitalization: A stable, top-quartile company in its sector.

- Superior risk-adjusted returns: Strong performance compared to industry peers.

Read More: Will Magna International’s Stock Forecast Improve Despite Tariff Setbacks?

What We Don’t Like:

- Overpriced compared to earnings: High P/E ratio suggests it is trading at a premium.

- Overpriced on cash flow basis: The price to cash flow ratio is above the sector median.

Learn More: What Canadian Stocks Would Trump’s Tariffs Hit the Most?

Future Outlook:

Teck Resources continues to navigate a complex trade environment shaped by U.S. tariffs and global economic shifts. While short-term challenges exist, the company’s strong financial foundation and strategic adaptations provide a pathway for resilience.

For investors, staying informed on trade policies, earnings reports, and market trends will be crucial in making well-informed decisions about Teck Resources and the broader mining sector.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.