Target Corporation (TGT) is set to release its Q3 earnings report on Wednesday, November 20. Analysts anticipate earnings of $2.29 per share, a 9.1% increase compared to the same period last year. Additionally, revenue is forecasted at $25.96 billion, representing a 2.2% year-over-year growth. These optimistic projections indicate a positive trajectory for the retail giant, reflecting robust demand and strategic operational adjustments.

Is now the time to buy Target Corporation? Access our full analysis report here, it’s free.

Expected Q3 Earnings Report of Target Corporation:

Market projections also highlight critical operational metrics. For instance, total revenue from sales is expected to hit $25.56 billion, while other revenues are estimated at $414.83 million, marking a year-over-year growth of 5.3%. The total number of Target stores is predicted to grow to 1,973, alongside increases in retail square footage. These improvements underscore the company’s continued expansion efforts, despite challenges in the retail sector.

Learn more about Target-related ETFs and investment options!

Stock Target Advisor’s Analysis on Target Corporation:

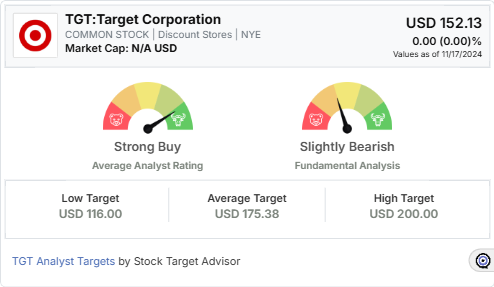

According to Stock Target Advisor, the outlook for Target Corporation is “Slightly Bearish,” grounded in two positive signals and three negative signals. Positive attributes include superior total returns and high dividend yields, positioning Target as a strong performer in its sector. However, concerns about poor risk-adjusted returns, high volatility, and below-median revenue growth temper this optimism.

As of the last closing, Target’s stock traded at $152.13, marking a 2.35% weekly gain but a 3.76% decline over the past month. Despite this, the stock has achieved a year-over-year capital gain of 17.12%, outperforming sector averages. Analysts have set an average target price of $175.38 for the next 12 months, with a strong buy consensus from 24 analysts.

Stay ahead with insights into the market’s top stock performers!

Conclusion:

The upcoming earnings report for Target Corporation is critical in shaping investor sentiment. While earnings per share and revenue estimates suggest solid performance, the broader analysis highlights the mixed signals around risk and growth.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.