Maruti Suzuki India Limited (MARUTI: NSE) is a standout performer in the Indian automotive sector, commanding a robust market share of approximately 40%. The company’s recent strategic focus on hybrid vehicles has positioned it as a top investment choice. By capitalizing on tax waivers in Uttar Pradesh, Maruti has successfully doubled customer inquiries in key regions. This approach aligns with the increasing consumer preference for cost-efficient and environmentally sustainable vehicles, solidifying its market leadership.

Is now the time to buy Maruti Suzuki? Access our full analysis report here, it’s free.

Analyst Projections and Valuation:

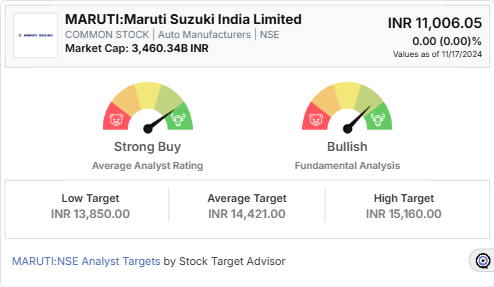

With a target price of INR 14,421.00 projected for the next 12 months, Maruti’s growth potential remains promising. Analysts rate the stock as a “Strong Buy,” driven by nine positive indicators including low volatility, superior risk-adjusted returns, and positive cash flows. Currently trading at INR 11,006.05, the stock’s expected 31% rise highlights its resilience and profitability in a competitive market.

Stay ahead in the market. Visit Stock Target Advisor to uncover Top-rated stocks and make informed investment decisions.

Key Strengths Driving Growth:

Below are the key strengths of Maruti Suzuki that makes it a top investment choice.

- High Market Capitalization: Maruti ranks among the largest and most stable entities in the auto sector.

- Superior Risk-Adjusted Returns: The company outperforms its peers on this metric over 12 months.

- Efficient Capital Utilization: Maruti has consistently delivered top-quartile returns on invested capital.

- Positive Cash Flow and Free Cash Flow: Sustained positive cash flow reinforces investor confidence.

Considerations for Investors:

Despite its strengths, Maruti faces challenges such as below-median dividend returns and higher pricing on a cash flow basis compared to peers. However, its overall financial health, combined with strategic market moves, mitigates these concerns.

In short, Maruti Suzuki India Limited remains a compelling investment choice with a bullish outlook and a solid foundation to capture future growth in India’s automotive sector.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.