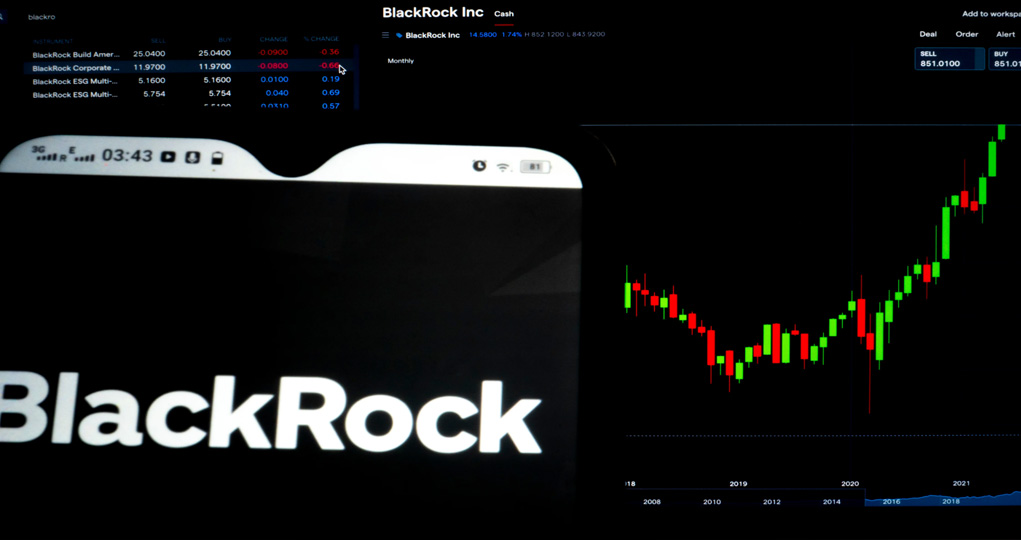

BlackRock (NYE:BLK), the world’s largest asset manager, joins the growing list of companies that are firing employees amid macro challenges. The company is reportedly planning to lay off roughly 2.5% of its workforce, or about 500 positions.

Financial Struggles

The company’s performance was impacted by uncertain markets due to Russia’s invasion of Ukraine, persistently high inflation, and rising interest rates. BlackRock continued to struggle in 2022 as its revenues and assets under management continued to decline.

Cost Cutting Measures

The new move is aimed at keeping expenses under control to support the company’s bottom-line growth. It is worth mentioning that BlackRock will report its Q4 earnings on January 13. Currently, the Street expects it to report earnings of $8.08 per share, down from the prior year’s figure of $10.42.

Is BLK Stock a Buy?

Despite the market concerns, BlackRock (NYE:BLK) witnessed a net inflow of $248 billion for the first nine months of 2022. The diversified offerings, along with strong demand for its technology platform, Aladdin, reflect well on the company’s growth prospects.

Wall Street Optimism

Also, Wall Street is highly optimistic about BlackRock (NYE:BLK). This is based on a Strong Buy consensus rating based on nine Buys and three Holds. The average BLK stock price target of $724.17 suggests nearly 4.2% downside potential. Shares have gained about 43% over the past three months.

About BlackRock

BlackRock is a global investment management firm that manages assets for individuals, institutions, and financial professionals worldwide. It offers a wide range of investment products and services, including equities, fixed income, cash management, and alternative investments, as well as risk management and advisory services. The company was founded in 1988 and is headquartered in New York City. It operates globally, with offices in over 30 countries around the world.